By Rawpixel.com @ Shutterstock.com

When stocks were down 1,600 points yesterday, “The websites of two of the country’s biggest robo-advisers—Wealthfront Inc. and Betterment LLC—crashed,” reports Bloomberg.

I’ve never been comfortable with the idea of robo-advisers. What if the technology ends up not working? Will the so called robos have the skill and patience that I know I have? Who knows?

The same is true with stop losses. I will never trust my hard earned money with program trading. I’ve never been comfortable with the idea, especially when it comes to stop losses.

With stop losses sell orders are placed when a stock falls below your pre-determined price. Sounds OK on paper, but in reality, the price that triggers the stop (or sale) is not the guaranteed price of the sale. You have to wait in line for your order to be executed. Imagine waiting for water in a natural disaster and you get the picture.

Then, of course, once the stock is sold at a less than desirable price what do you do next? Are you in a better position for long-term investment success? When do you get back in?

This is exactly how investors react in a 1,600 point crack in the market. They are the market. Don’t get caught up in it. Make a plan and stick to it.

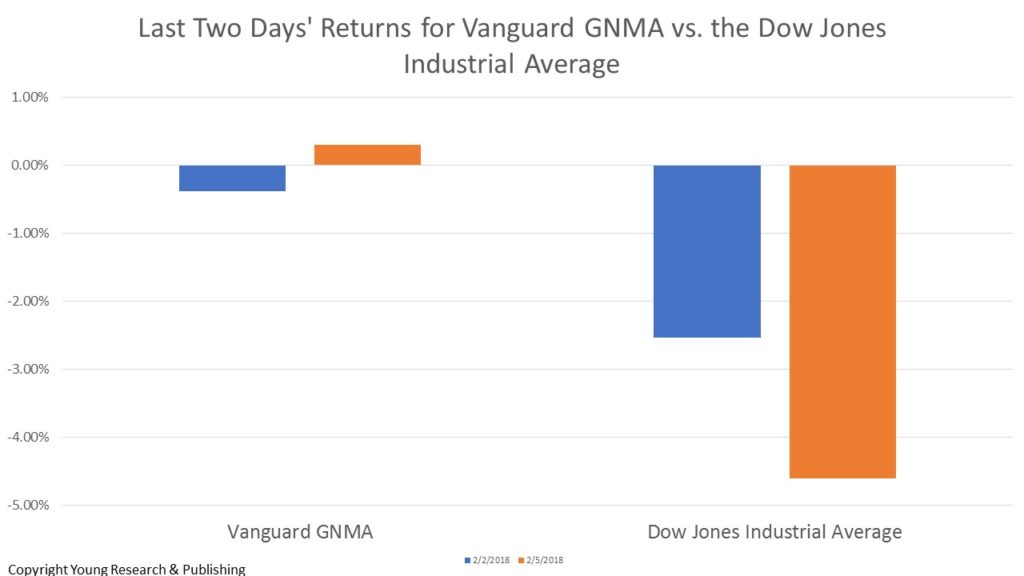

I plan on keeping my Vanguard GNMA. I made money with it yesterday. Yes, it has been tough sledding for bond investors, but no one ever said investing was easy. I have never wavered on my Vanguard GNMA position and never will.

Vanguard GNMA is a lifetime holding for me.

As for robos and stop losses, why trust your money to computers that either don’t work or guarantee your stocks will be sold at a price you may not be happy with? No thanks.

Originally posted on Yoursurvivalguy.com.