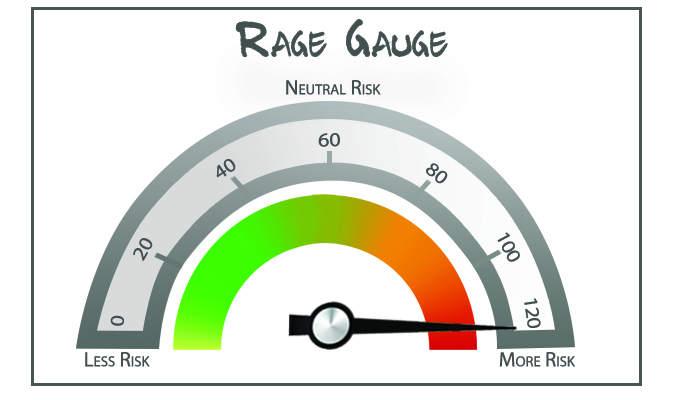

Let the parties continue, because the punch bowl is still flowing. Yesterday, when the Fed announced a tighter monetary policy—an end to bond purchases and three rate increases—markets cheered. Because halting asset purchases and raising rates a whopping three times is like moving a few ornaments on your Christmas tree. It’s all for show. And just like the “Jingle Bells” refrain, the Fed’s just another reindeer pulling Biden’s sleigh. It’s free money for all, and to all, a good night. What could possibly go wrong?

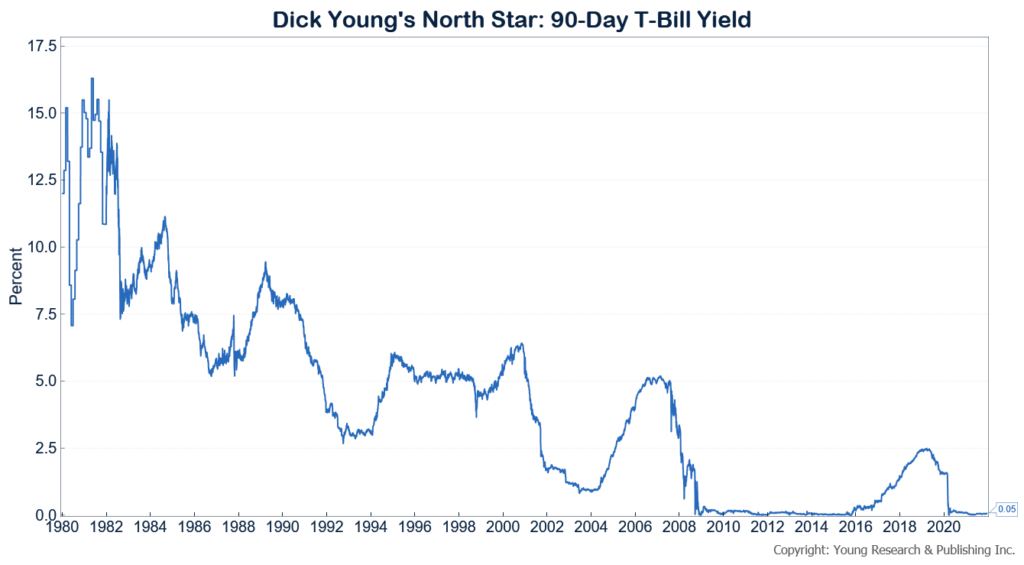

For serious Americans like you—the savers, entrepreneurs, small business owners, executives, retirees—this is not news. This is a disgrace. Three rate increases? That’s about as high as the stand propping up your tree, and is hardly near the top where Richard C. Young’s historic North Star belongs.

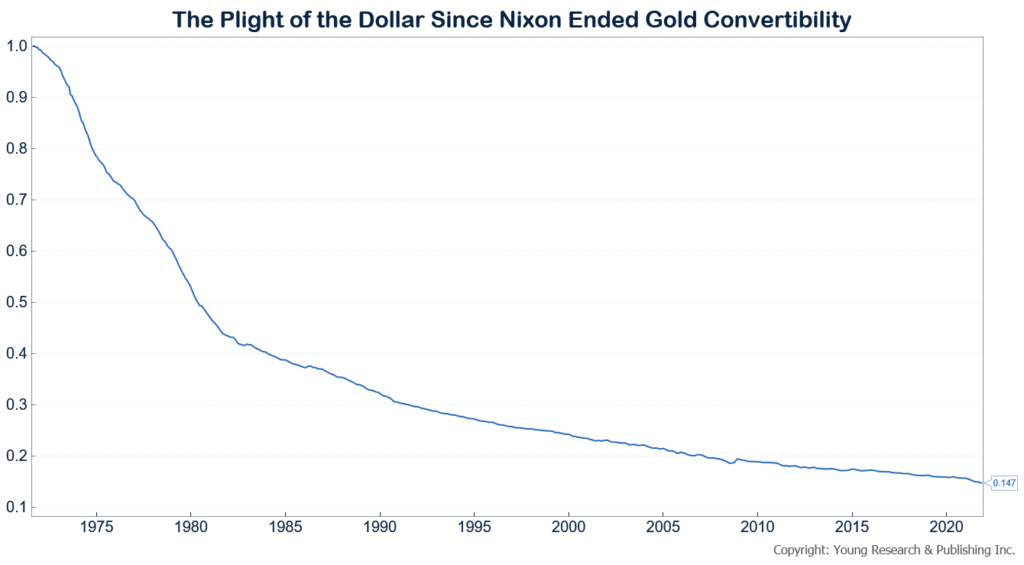

And since when is inflation transitory? The Fed’s in the inflation business and has been for years. It’s what they do.

Action Line: Central banks the world over talk about “soft” landings. Listen, I’m not a pilot, I’m Your Survival Guy, government has a history of screwing up landings and cleaning up the wreckage after the crash. I’m not in the prediction business. Prices are what they are. They can go as high as someone else is willing to pay. Prices are essentially a qualitative event. I want you focused on the quantitative. In other words, I want you to get cold hard cash in the form of dividends to be “invested” in the chaos.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.