“Don’t just do something, stand there,” is one of my favorite quotes by the late, great Jack Bogle, founder of the Vanguard Group. In one sentence, you understand the emotional challenge of being a successful long-term investor. Easier said than done.

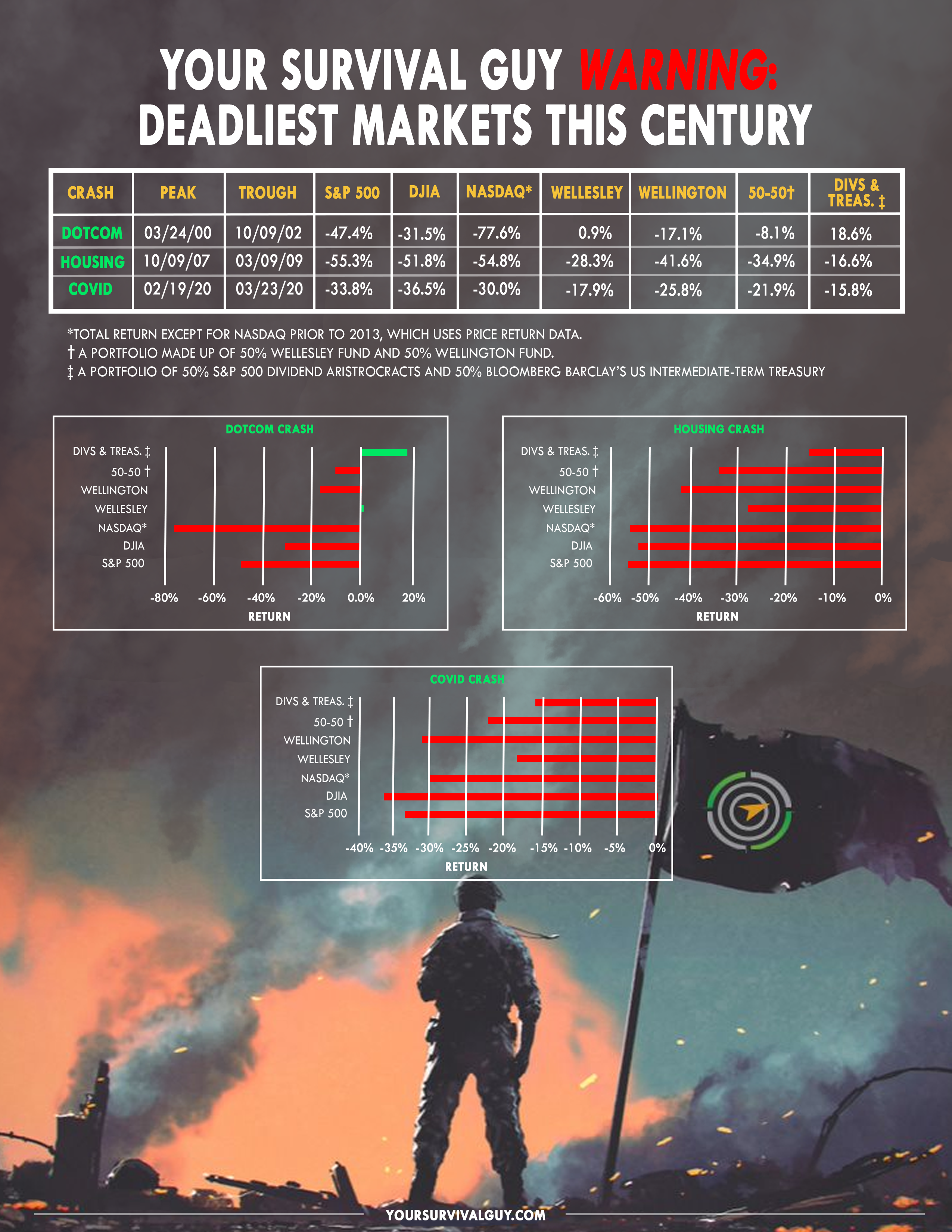

“I don’t want a repeat of 2008,” a client said to me yesterday.

“I agree,” I said.

“What can we do to avoid it?” he asked.

“Well, for one, back in 2008 we weren’t working together. Now we are. And based on the balanced nature of your portfolio today compared to then, you don’t have all your eggs in one basket.”

And that’s the key. As we get older and we no longer have a paycheck to help “get back what was lost,” we need to be vigilant about protecting what we have. We can’t afford to see 40% of a portfolio vanish overnight.

One of the more frequent statements I hear from investors is, “I don’t understand bonds.” That’s OK. What you do need to understand is the role they play in a portfolio, especially as you shift toward income and safety.

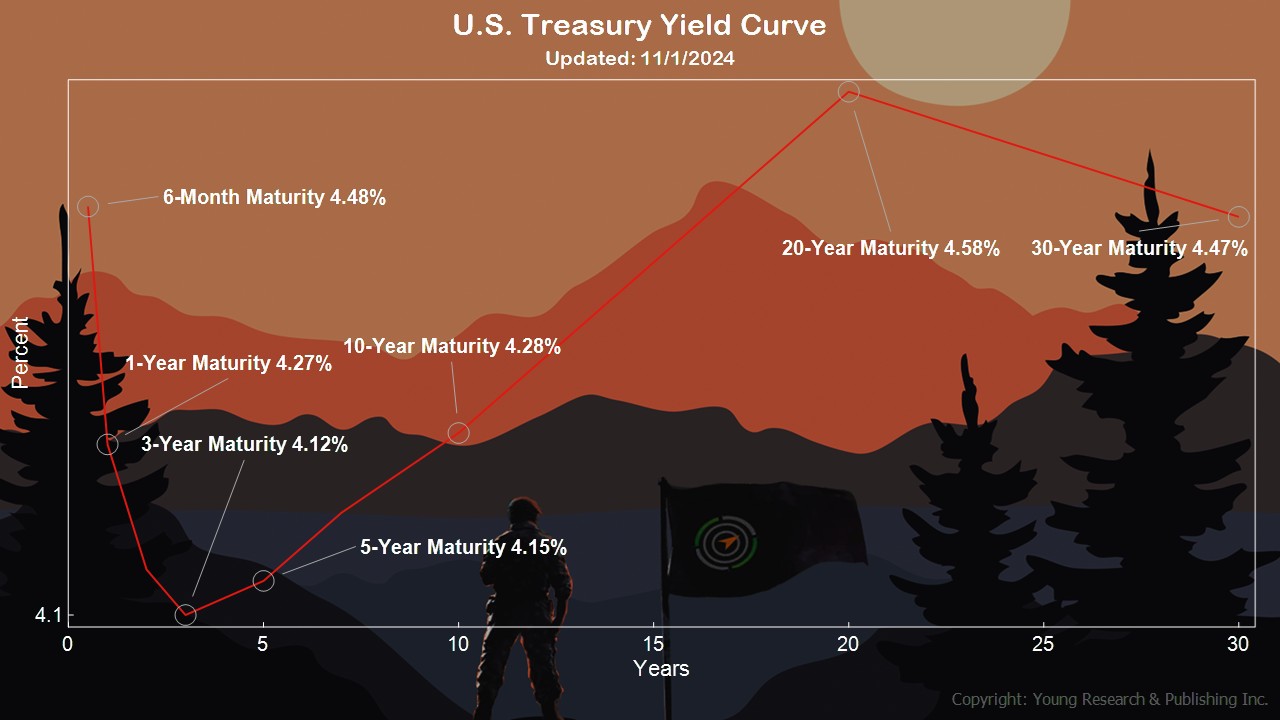

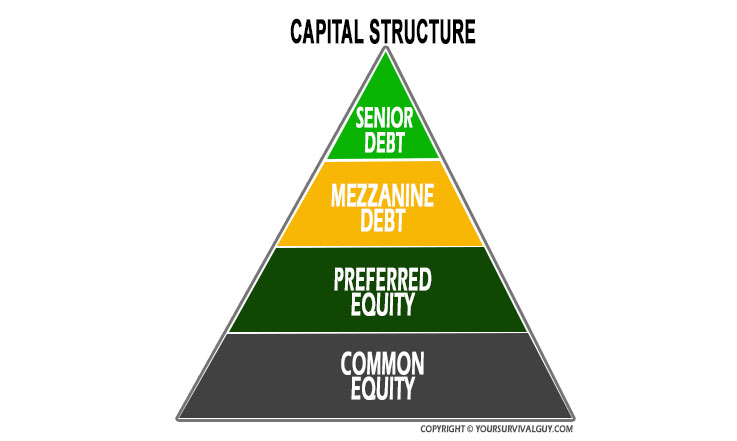

As Your Survival Guy, I want you to think about bonds in terms of capital structure. Where are they in the capital structure of a company or the country like full faith credit Treasuries. Understand that, as a bondholder, you’re higher than the common stockholder, meaning you get paid first.

When it comes to bonds, don’t get caught up in price fluctuations. Instead, focus on the income generated by a diversified mix. Think about your margin of safety first. Then, construct your portfolio knowing what you can handle.

Action Line: Your ability to “Just don’t do something, stand there,” comes from understanding your risk tolerance. Too often, investors don’t know they’re intolerant, like a food allergy, until it’s too late. I’m here to help you understand you understand you. Email me at ejsmith@yoursurvivalguy.com, and let’s talk.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.