“I like people who don’t need everyone to like them.”

-Tony Soprano, ‘The Sopranos’.

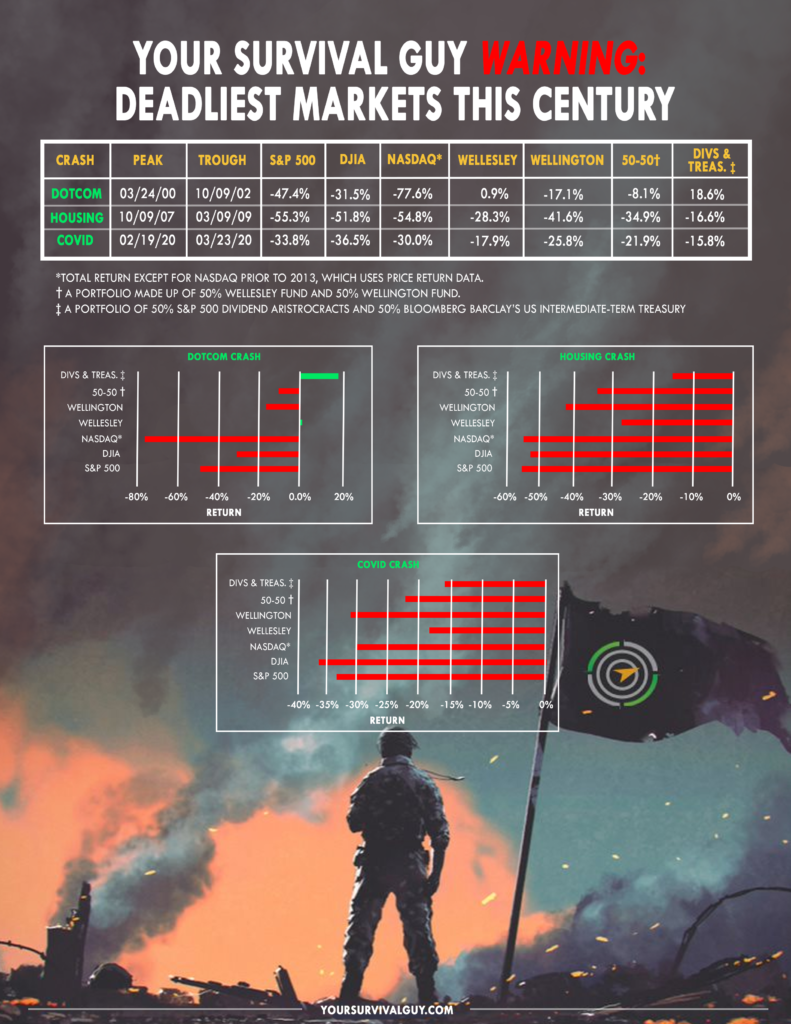

There’s been some yappin’ lately about bonds. Why own bonds when yields are so low? Let me explain. In times of trouble, look at who gets paid first, and you realize why bonds tend to do fine when the stock market falls apart. Look how Treasuries saved portfolios earlier this century.

Actor James Gandolfini from HBO’s “The Sopranos,” accompanying a USO tour in Kuwait City on March 31, 2010. (DoD photo by Mass Communication Specialist Chad J. McNeeley/Released)

When you invest your cold hard cash, you’re lending your money to the street, if you will. Think about your bond money like it’s Tony Soprano. Do you think Tony liked it when he wasn’t paid? Does anybody? No. But those who crossed Tony had more at risk than a late fee on their electric bill. Hmmm, should I pay Tony or National Grid?

O.K. That’s how I want you to think about your bonds. They’re your family, your Tony Sopranos, doing the dirty work to make sure you get paid. Because it’s not only the street rules, it’s the law—a company’s capital structure places you—the bondholder—above stocks. Your interest payments are treated with the respect they deserve, that of a Tony Soprano, not a Rodney Dangerfield. You get paid first. Period.

Action Line: In times like these, it’s not how much you get paid, it’s that you will get paid. Sure, you don’t want Tony Soprano running everything in your life, but it sure is nice having him on your side when stocks misbehave. If you need help building a plan to incorporate bonds into your portfolio, I would love to talk with you.

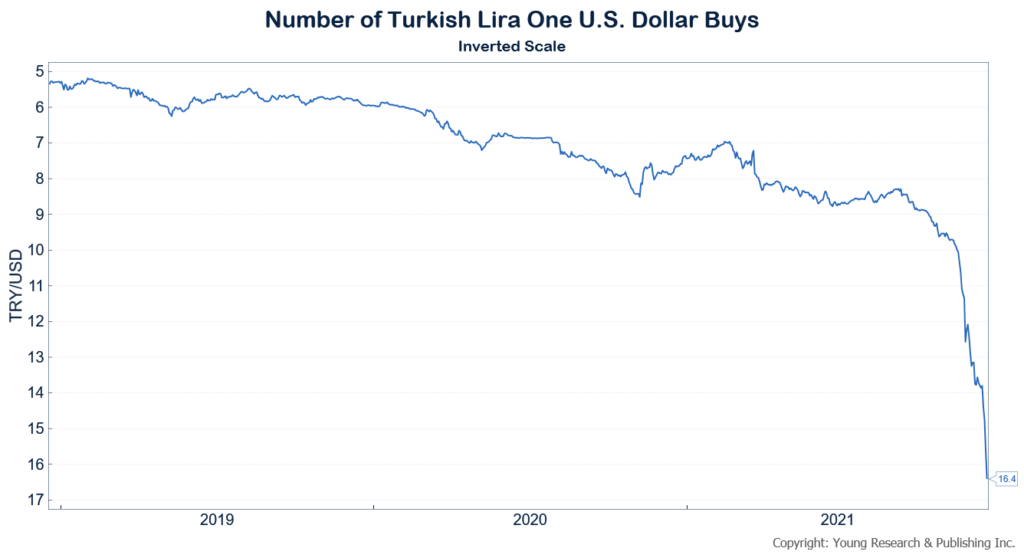

P.S. And don’t forget, your U.S. corporate bonds are paid in dollars. Have you seen what’s happening in Turkey?

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.