President Donald J. Trump disembarks Marine One and applauds the crowd waiting to greet him as he arrives to Ashville Regional Airport Landing Zone in Ashville, N.C. Monday, Aug. 24, 2020, for his visit to Flavor First Growers and Packers in Mills River, N.C. (Official White House Photo by Shealah Craighead)

How are you feeling about your portfolio? Are you feeling good about how you’re positioned for the Trump Trade? How about investing the proceeds from CDs as they mature? Do you let them roll over into another one or use the proceeds to take a flyer on the economy? What if it doesn’t pan out the way the prognosticators are predicting?

The mainstream media thrives on booms and busts. They get rich growing their audience. When attention spans are mere seconds, and the competition for viewers is fierce, they’ll say almost anything to keep you tuned in. Your job is to survive it all.

When Warren Buffett is a net seller of stocks, you may want to double-check your exposure to stocks. In my conversation with you, you tell me about the grand slams you’ve hit with a handful of stocks, but you wring your hands because you’re stuck. You don’t want to sell because the tax bite will be enormous.

“Oh, but I’ll sell when the crash comes,” I hear.

“Really?”

One of the more difficult tasks for the armchair investor is to sell. To admit defeat. He counts how far ahead he still is, right up until it’s too late.

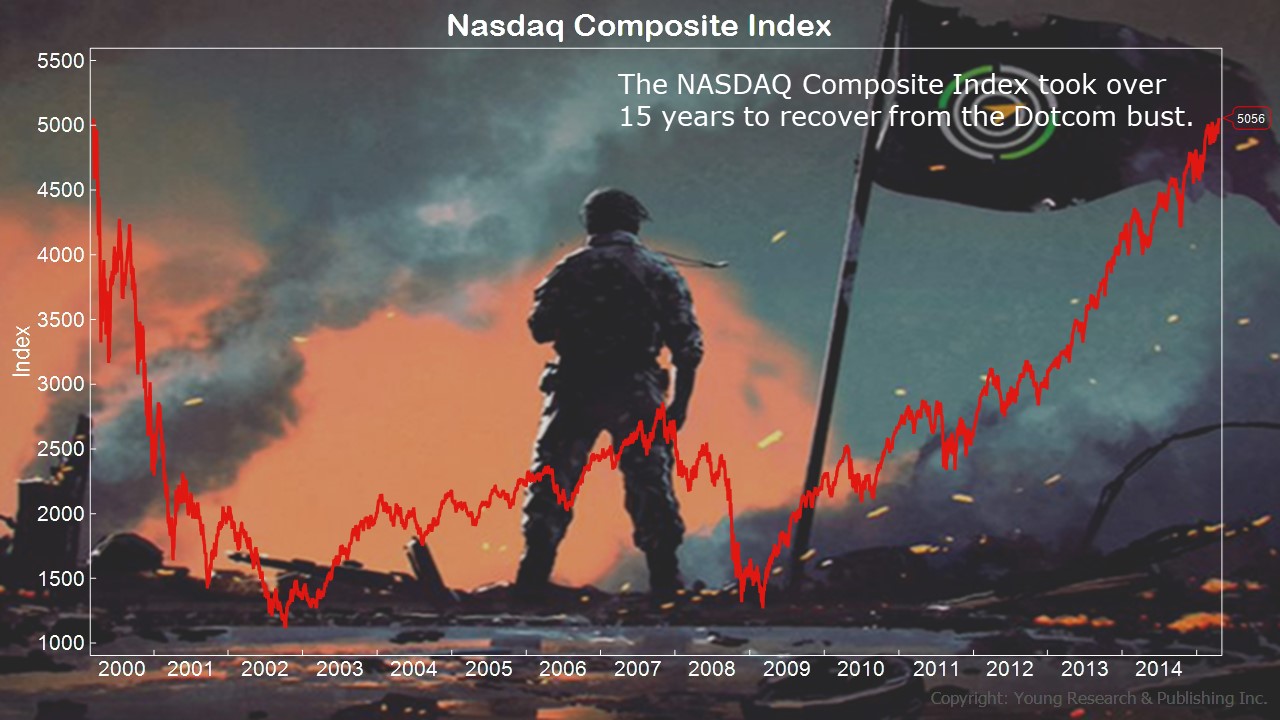

When you look back at the NASDAQ index during the tech bust and see how many years it took investors to get back to even, it’s frightening. And it’s easy to forget that many stocks never came out of it. That’s the danger of not being diversified. Imagine if you retired at the beginning of it all.

Action Line: Markets are brutal. You’ll see. When you’re ready to talk, let’s talk. But only if you’re serious. Email me at ejsmtih@yoursurvivalguy.com

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.