You and I both know there’s inflation today. It’s at the grocery store, education, real estate, taxes etc. As long as there is government controlling your money, there will be inflation.

As I write here, cash may be king in a sudden disaster, but should be paired with a hard asset hedge for long term protection:

Cash is king! Try selling that one to your spouse. But cash ispretty powerful. You never know when you’ll need it. Like when there’s a Wi-Fi outage that shuts-down businesses. No Wi-Fi, no credit cards. No Pizza. Cash is powerful to an empty stomach.

But predicting an outage is as fruitless as predicting the future price of gold. And unfortunately over time, your cash gets weaker and weaker the longer is sits around the house collecting dust. It’s pretty lazy.

So, I didn’t want to just take out a pile of cash, lock it up and know I was losing money every year for the rest of my life. Yes, inflation is low. Wait a minute. Hold on. No one told that to folks at our local farmers market, where they sell a carton of a free-range eggs laid by stress free chickens that have never been told “no” in their life. Or to the folks at Kerrygold and their grass fed butter (it’s worth every penny).

What I set-out to do was to create a 50/50 hedge for any gold/cash storage. For example, ten years ago I wanted $5,000 cash so I matched it with a purchase of $5,000 worth of gold.

The idea being that with my cash and gold collecting dust, I wanted to at least have a chance to win the war against my lazy cash. And I did. Both are still collecting dust.

Don’t be lulled to sleep here. Despite low inflation for the last few years, things can change quickly in the investing world, as I wrote here:

No one knows exactly how this race to the bottom by Central Banks will end. But it is clear that they don’t have much regard for maintaining the value of their currencies. “It makes a great deal of sense to own gold. Other investors may be finally starting to agree,” Billionaire hedge fund manager Paul Singer wrote in an April 28 letter to clients. “Investors have increasingly started processing the fact that the world’s central bankers are completely focused on debasing their currencies.”

There was a time when I was at Babson where you wouldn’t laugh at the idea of investing your client’s retirement money in T-Bills. Now we’re paying the government, after inflation, to lend them money. Where in the world does that make sense?

It makes sense to the pols in Washington, D.C. and where they go to retire, at Goldman Sachs. Good ‘Ole Goldman came out with an investor note on May 10 revising downward their expectation for gold based on expectations of Fed tightening. The Fed may tighten, but team Yellen will do whatever it takes to make sure their girl wins in November. Make sure you own some gold.

The gold rush is on, from the WSJ:

Abating expectations for Federal Reserve rate increases have fueled a fresh boom in everything that glitters, from gold futures to the shares of gold-mining firms to exchange-traded funds that give traders a way to bet on gold’s daily rise and fall.

Front-month Comex gold futures have been among the best-performing major asset classes in financial markets this year, up about 20% as of Thursday. But those gains have been dwarfed by the surge in many gold-related securities, the latest sign of the topsy-turvy trading across markets in 2016 that for now has transformed some of the least-beloved investments on Wall Street into top performers.

The gains reflect a vast shift in investor expectations over the past six months. Many analysts and portfolio managers entered 2016 expecting the U.S. dollar to resume its rise as the Fed carried out a series of interest-rate increases. Instead, the dollar this week hit a five-week low after soft U.S. jobs data and comments from Fed Chairwoman Janet Yellen made clear that no increase is imminent, extending a commodity-sector rebound whose size and longevity have surprised many investors.

“It’s been an unbelievably quick change from despair to euphoria since the beginning of the year,” for gold miners, said Rick de los Reyes, who helps manage $1.4 billion in metals and mining at T. Rowe Price Group Inc.

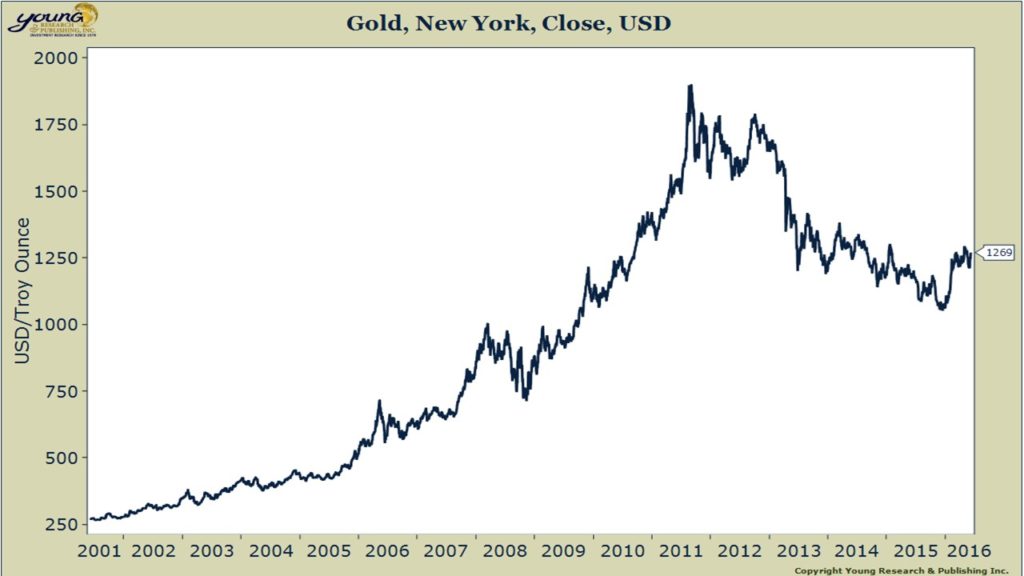

As you can see in this chart, the government will not protect your dollars. It’s why I’m using the price per ounce of gold in my RAGE gauge so we can see what a poor-inept steward the government has been for you and your family.