When the S&P 500 lost 9 percent in December it marked the worst December since the Great Depression year of 1931 when the index was down 14.5%.

When the S&P 500 lost 9 percent in December it marked the worst December since the Great Depression year of 1931 when the index was down 14.5%.

For all of 2018, the S&P 500 lost 6.2% compared to a loss of 47% in 1931. Now let’s not forget what the carnage looked like from the beginning of the Great Depression, signaled by the crash of Oct. 29, 1929, to its end in June 1932. The S&P 500 dropped 86 percent in less than three years, and did not regain its previous peak until 1954.

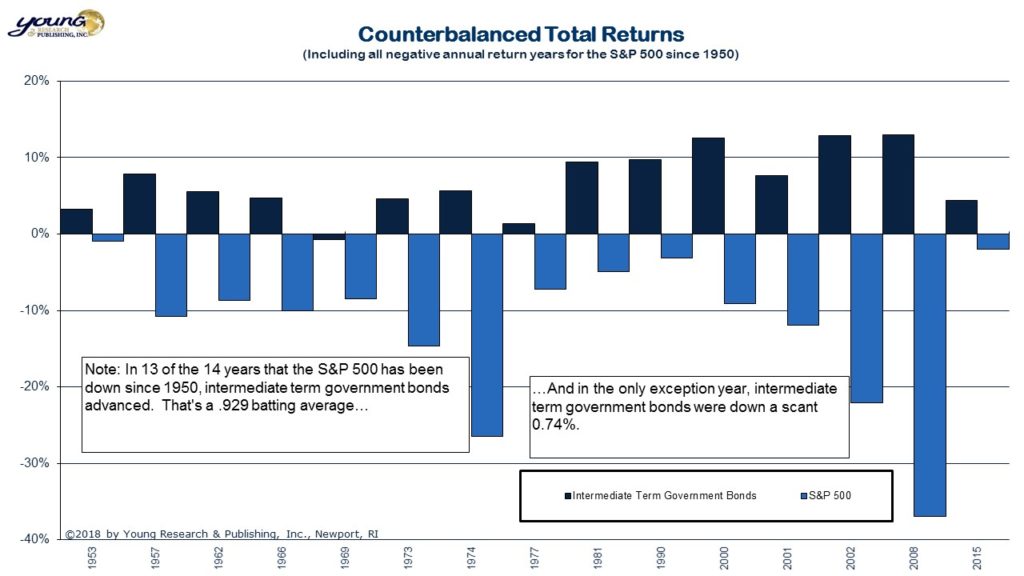

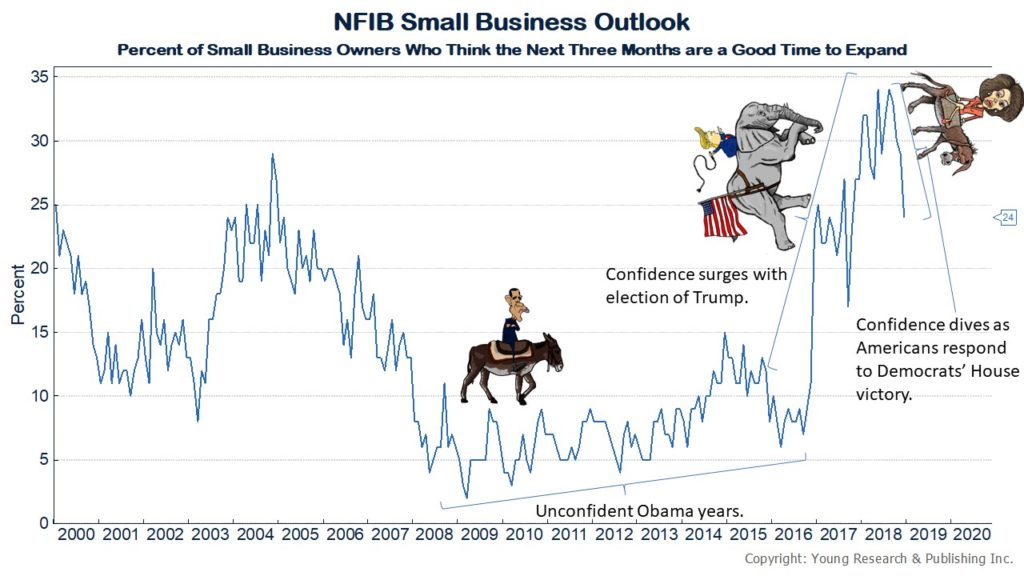

America has already had two nasty peak to troughs this century, with the tech and banking busts of 2000 and 2008. If you felt uncomfortable in December, that’s normal. But if you were kept up at night and did not enjoy Christmas and New Year’s, then it might be time to reconsider your current investment mix.

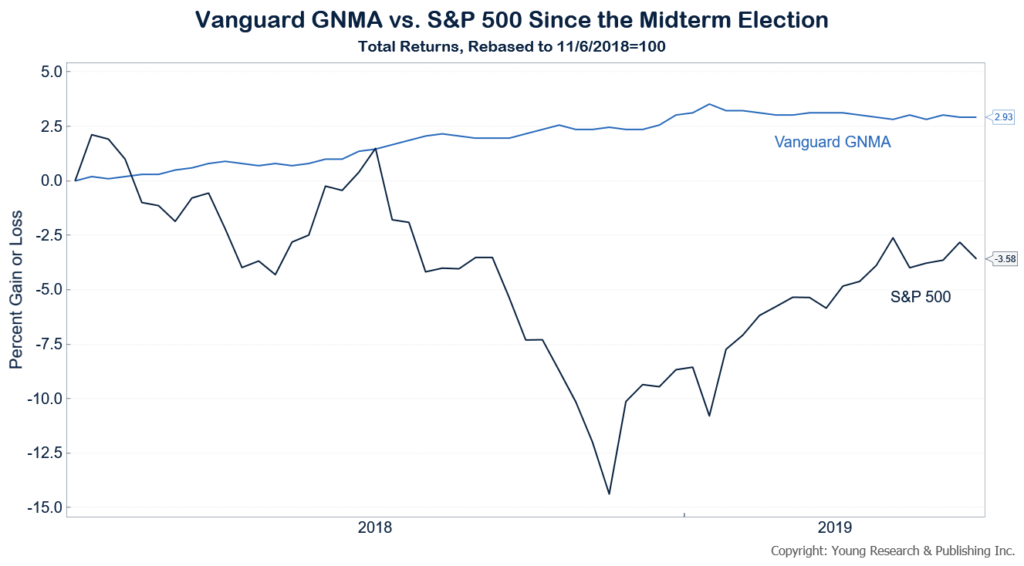

Remember, counterbalancing can be your friend during times of trouble as I’ve shown with Vanguard GNMA’s post mid-term rally. As the late, great Jack Bogle commented about his balanced portfolio: Half the time he liked bonds and half the time he didn’t. My RAGE Gauge continues to flash caution signs.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.