In case you missed it, here’s what Dick Young wrote in his December 2016 issue of Intelligence Report:

My Revitalized Market Tension Index (MTI)

When will we know that the economy has entered recession? This month, I am reintroducing my Market Tension Index (MTI) to help you and I determine whether the economy is in recession. This will be the first of what are likely to be many more proprietary indicators and tools I plan to roll out to help you become a more comfortable, confident, informed investor.

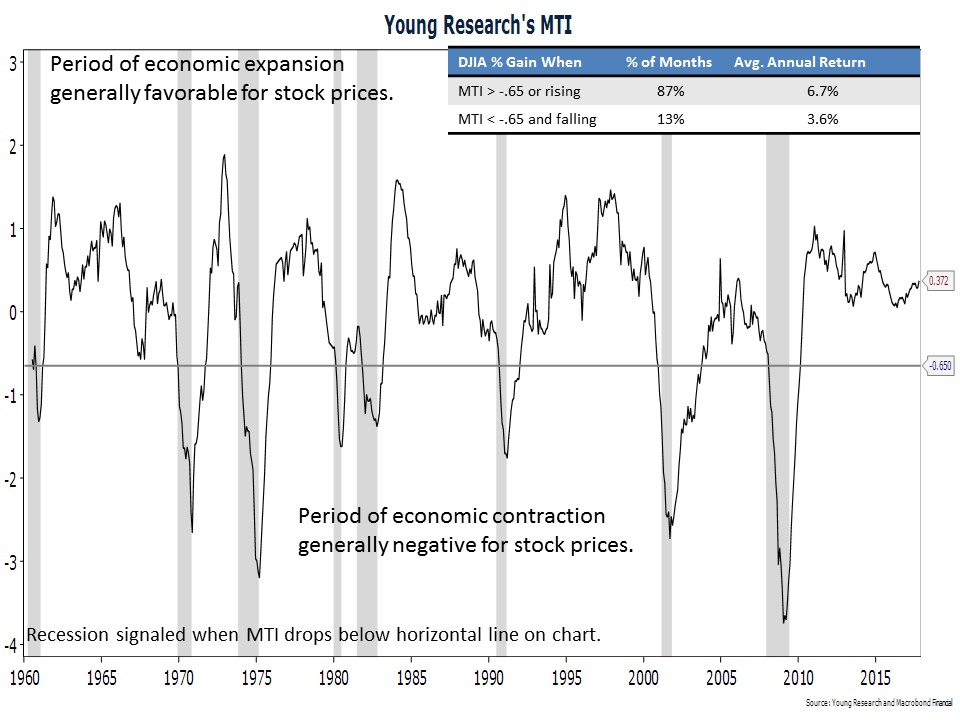

My revitalized MTI is a composite index of indicators that have historically peaked at the onset of recession. I have transformed and adjusted the raw data to provide a reliable signal of when the economy is in recession. Below is a long-term chart of my MTI. The shaded areas indicate periods of recession in the economy.

As you can see in the chart, my MTI begins to fall sharply at the onset of recession. Every drop in the MTI does not signal recession, but every time the MTI drops below -0.65 (the horizontal line on the chart), after a period of economic expansion, you should be confident the economy has entered recession. How confident? Every single recession since 1960 has been associated with an MTI reading below -0.65, with no false signals.

Here’s how Young Research’s MTI looks today (as of 10/31/2017):

Like Dick Young, I also provide you with an overall risk perception gauge with my monthly RAGE Gauge. And, as we saw last month, investors’ perception of risk is not nearly as high as it should be. My RAGE Gauge, a measure of risk perception, should be much higher than it is, but the numbers don’t lie—once again, investors aren’t paying attention to RISK.

Originally posted on Yoursurvivalguy.com.