UPDATE 6/27/22: I don’t want to harp on cryptocurrency speculators. They’ve been through a lot lately and not much of it good. The news that Three Arrows Capital, a Singapore-based cryptocurrency hedge fund is at risk of defaulting on $675 million in loans must be pretty terrifying for the crypto market. During all their time speculating on the newest technological innovation, crypto investors ignored the one magical power available to them, compound interest. Now, investors in Three Arrows are at risk of losing everything. Baystreet reports on the firm’s imminent collapse:

Singapore-based Three Arrows is one of the largest and most prominent cryptocurrency hedge funds. But it is facing a liquidity and solvency issue as billions of dollars have been wiped off the cryptocurrency market in recent weeks as prices for Bitcoin (BTC), Ethereum (ETH), and other digital assets have plunged.

Voyager Digital (VOYG), a cryptocurrency brokerage firm, lent Three Arrows 15,250 Bitcoins and $350 million of the stablecoin USDC, totaling $675 million U.S. The entire loan is due to be paid back today (June 27).

None of the loan has been repaid yet, Voyager said last week, adding that it may issue a “notice of default” if Three Arrows does not pay the money back.

Voyager, which is listed on the Toronto Stock Exchange, has seen its shares fall 95% this year.

Three Arrows Capital was established in 2012. The onset of a so-called “crypto winter” has hurt digital currencies and related companies across the board in recent weeks.

Originally posted April 5, 2022.

Back in 1964, I began a lifelong mission as a disciple of compound interest investing. In those earliest days, home base was Clayton Securities at 147 Milk St. in Boston’s financial district.

By 1971 I had gotten into institutional trading and research with Model, Roland & Co. on Federal Street. My first accounts were Fidelity Investments and Wellington Management.

Today, over 50 years have somehow flown by, and I am still doing business, a whole lot of it, daily with Fidelity (my family investment firm’s custodian) and Wellington (my own account’s largest positions).

Wellington, for its part, manages billions of dollars in client assets for Vanguard. In the late 80s and early 90s, my friends at Vanguard let me know that my newsletter was responsible for directing more assets Vanguard’s way than the rest of the newsletter industry combined.

Jack Bogle, the founder of Vanguard, was a friend of mine from Jack’s days at Wellington., Jack provided the key testimonial for my first book.

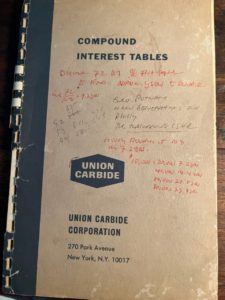

The focus and foundation for my five-decade adventure has been rooted in one little phrase: compound interest. The accompanying photo is my tattered little Union Carbide spiral booklet.

The focus and foundation for my five-decade adventure has been rooted in one little phrase: compound interest. The accompanying photo is my tattered little Union Carbide spiral booklet.

In 1992, Debbie and I bought a little pink Conch cottage in Old Town, Key West, just 90 miles from Cuba. Our son Matt has been our president since, and our daughter Becky is our chief financial officer. E.J. (Your Survival Guy), our son-in-law, after a valued internship with Fidelity, is director of client services.

I continue to research and write seven days a week on behalf of our firm’s clients. Debbie and I still live in Key West, and we do a lot of our research in the 8th arrondissement of Paris. The six-hour time difference works to our favor in getting material to our editorial staff back in Newport, RI.

Thanks to one basic concept – compound interest – I have been able to comfortably and with astounding consistency plot the course for our ultra-conservative, balanced investment firm for over five decades.

You can bet that Debbie and I were pretty proud when our son Matt recently called to tell us that Barron’s had informed him that he had been selected to Barron’s Hall of Fame (2012-2022), while CNBC had just ranked our modest investment management firm #5 in America (2021) out of more than 14,800 registered investment companies. I guess when all is considered, there is a lot of good that be said about compound interest, consistency, and the value of the Prudent Man Rule. (Richard C. Young & Co., Ltd. has never paid a fee to be considered for any rankings, but does pay a license fee to utilize them. Please click on the attached link to read the full disclosure).

As they say, “It works for me.”

Dick Young

Old Town Key West

5 April 2022

90 miles from Cuba

Originally posted in Young’s World Money Forecast.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.