Remember when former Fed Chair Alan Greenspan was referred to as “The Maestro” conducting the economy to a soft landing during the 90s? The only problem was when the music stopped, like it did during the Tech Bust earlier this century, hopes and dreams were crushed.

The Maestro’s symphony could have been titled “This Time It’s Different,” lulling its listeners like the Pied Piper right up until the last movement that could have been subtitled “Turns Out, Not So Much.”

Today, plenty of talking heads are cheering conductor Powell’s rate cut, but what if investors continue bidding up stocks only to be heartbroken at the most important investment time of their lives—their retirement years?

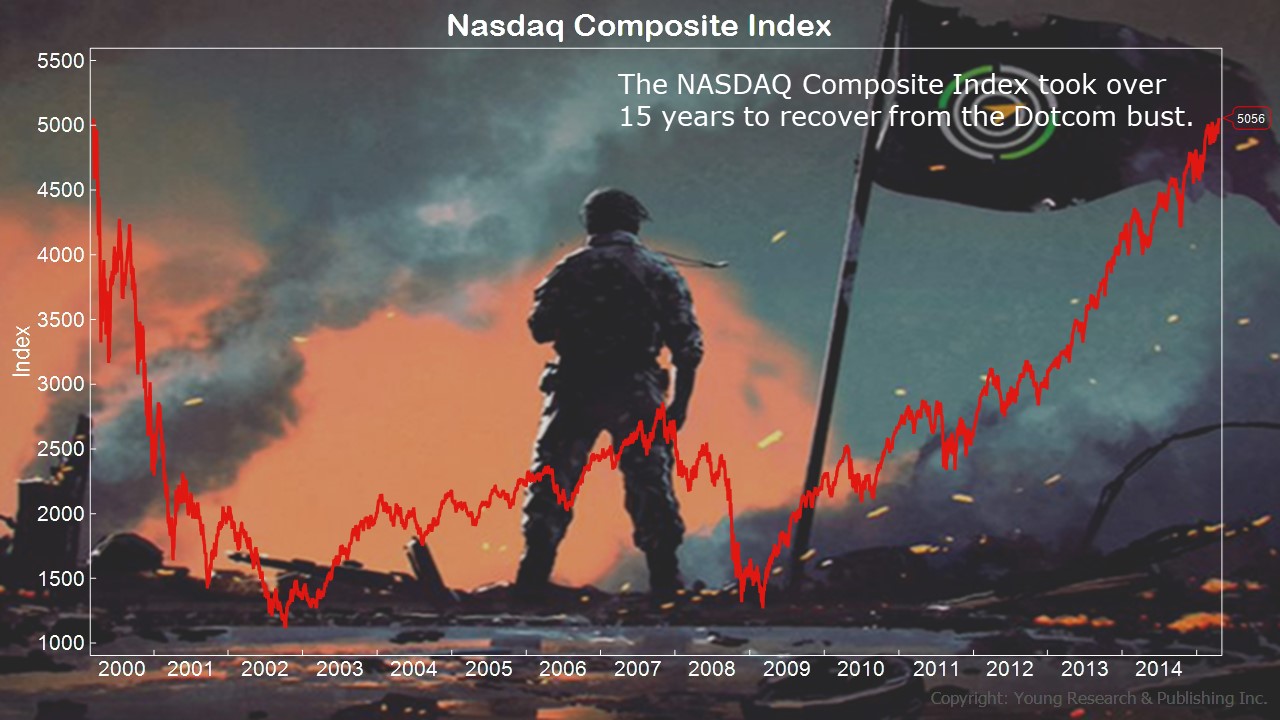

As an aside, during all those years it took the Nasdaq to recover, most early investors were long gone—scarred for a generation—never to return to stocks in their lifetime. And those who stuck around earned hardly a dividend for their patience.

Your Survival Guy did a recent study on dividend-centric equity funds. You can see the table below to draw your own conclusions.

Action Line: We live in a time where prices are running the show. You and I know prices come and go, but income in the form of dividends is tangible. If you want to talk about a dividend-centric stock portfolio, email me at ejsmith@yoursurvivalguy.com, and we can talk. But only if you’re serious.

Read Part I here.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.