Are you familiar with the efficient frontier? More on this in a minute. First, let’s talk about risk.

One of the more helpful exercises in understanding your own risk tolerance is imagining how you will react if your stock portfolio declines by 30% or so. You can do a historical review of how you reacted in times when markets took a beating. How did you feel? And how did you react?

Where you are in your stage of life is crucial, too. If you’re soon to be retired or newly retired, this is most likely uncharted water for you in terms of stock investing and your emotions. When you no longer have a paycheck and you’re in your 60s, that lifeline isn’t what it used to be.

That’s OK. You deserve to have the retirement you dreamed about. But as Your Survival Guy, I wonder about downside protection.

When you get your fixed-income house in order, a lot of good can happen. What I’m thinking about specifically is getting a handle on your stock market exposure. Look at my efficient frontier and see how you might want to be allocated.

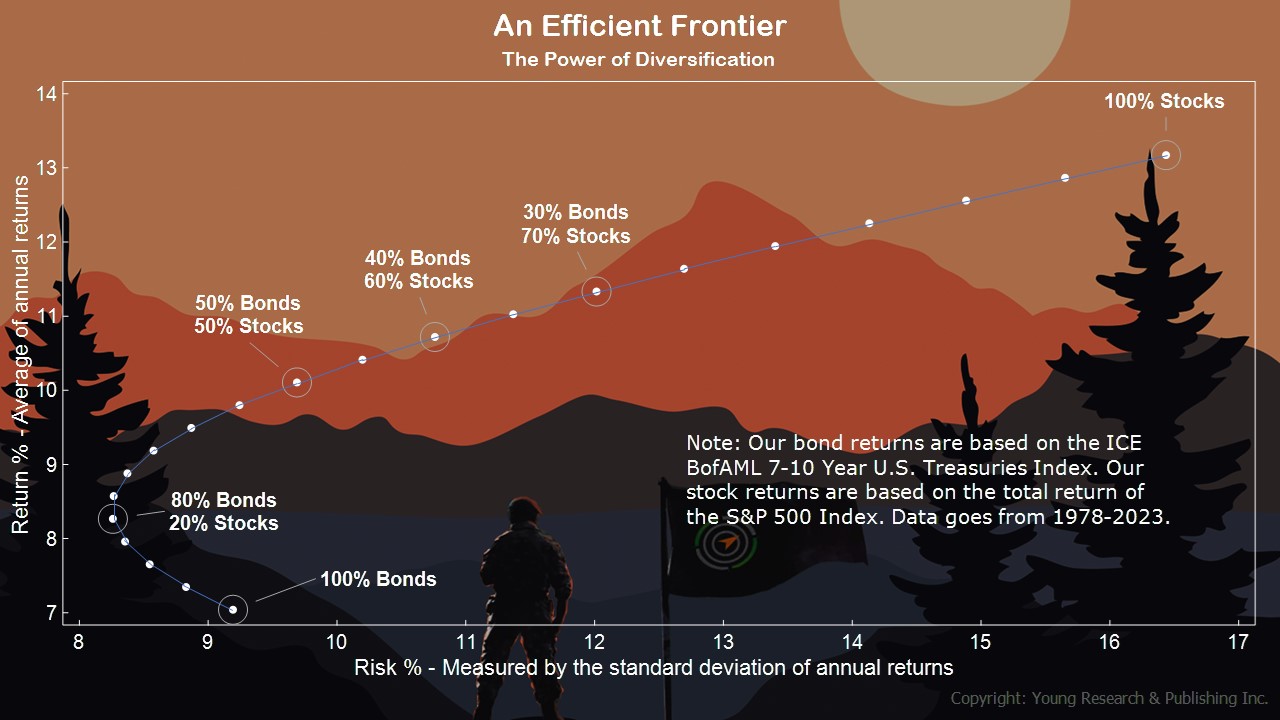

The Efficient Frontier, created by Harry Markowitz in 1952, measures the efficient diversification of investments that delivers the highest level of return at the lowest possible risk. Investors must consider the trade-offs between risk and reward in their portfolios. You can see on the chart above an efficient frontier line representing risk vs. reward for a portfolio allocated between different proportions of stocks and bonds using data back to 1978.

On the vertical axis is the return earned by the portfolios, and along the horizontal axis is a measure of how much risk was taken to earn those returns. As you can see by comparing the portfolio of 80% bonds and 20% stocks to the portfolio of just bonds, as portfolios take on a small number of stocks, the benefit of diversification lowers risk and increases reward. Anything above the line is unachievable because no portfolios earning those returns are available at the corresponding risk levels. And any portfolios that fall below the line can be outperformed with the same amount of risk or have their returns matched with less risk.

But to achieve higher returns along the line, investors adding more stocks to their portfolios are taking on ever greater amounts of risk. A portfolio of 100% stocks boasts a standard deviation of over 13%. Be aware of the risk in your portfolio and manage it wisely.

Action Line: When you’re ready to talk, let’s talk.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.