Excerpts from my Wednesday presentation to recent grads and associates of an esteemed NYC med school:

How to Invest and Create Wealth

You’re asking me how to invest. Here’s what I recommend: Start early, participate in your company’s 401(k), reduce your debt, cut your spending, save ‘til it hurts, work as long as you can, and teach your family about money. That should get you started. Doesn’t sound like much fun? I know. But this does.

Time Travel is Fun

Imagine stepping into a time machine traveling into the future. You spent the day opening up your summer home in the Hamptons, on the Cape, or here in Newport, RI, and you can feel the ocean breeze, the salt air on your skin as you spread newspapers out on your patio table getting ready for the first lobster dinner of the season. Your family will be arriving shortly. It will feel great sitting down, taking in a deep breath, talking about the weekend, and knowing you have the work you love to do after a long weekend. Wouldn’t that be pretty nice? It would be.

Time Travel Can Be Dangerous

Well, it doesn’t have to be a dream. The reality is, in 30, 35, 40-years, you’ll have an investing career to look back on, and what you make of it is up to you—you’ll be navigating your retirement years. But, a word of warning. Along the way—because of who you are—you’re going to hear from a lot of family, friends, past and current associates, and classmates. They’ll introduce you to investors that will jump through hoops to get you to invest in their “can’t miss ideas.” You need to be informed. You need to be your own best advocate.

Albert Einstein’s: 8th Wonder of the World

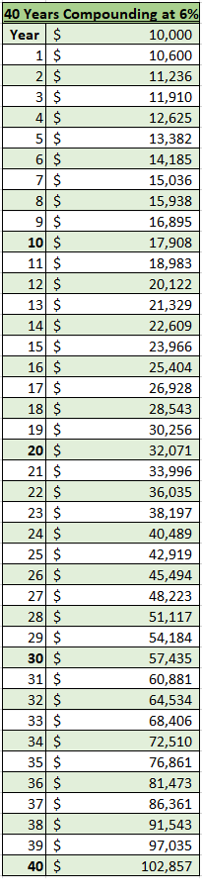

You can become wealthy beyond your wildest dreams if you keep what you make and put compound interest—Albert Einstein’s 8th Wonder of the World—to work for you. Compounding, or earning interest on interest, is magical. With compound interest, you don’t have to hit home runs to build generational wealth. For example, if you invest $10,000 today (or save $833 a month and invest $10,000 a year from today), compound it annually at six percent per year, it will be:

- $57,000 in 30-years

- $77,000 in 35-years

- $100,000 in 40-years

TIME

Miracles do happen when you put TIME on your side. When you harness the power of compounding at a reasonable rate of return, as you can see above, you almost double your money from years 30 to 40 (or in only ten years) from $57,000 to $100,000 because of time. That’s how you turn ten grand into a hundred. And that’s not even my favorite investment.

My Favorite Investment is Y-O-U.

My favorite investment is Y-O-U. Not the stock market. Not bitcoin. Just you. I want you to remember this: Invest in yourself to make money. Invest in the market to SAVE it. Because as soon as you start looking for the market to do something for you and hope it goes up, you run the risk of getting into trouble by doubling down or leveraging your portfolio with borrowed money. Hope is not a strategy. The market doesn’t care if you need it to do something for you.

Losing Money

And the best way to SAVE money is to not lose it, which is investment rule number one. Rule number two: Don’t forget rule number one. And, I’ll point out here, I’ve yet to meet an investor, no matter their net worth, that likes losing money or can “afford” to lose money. Carry that mindset with you— invest every dollar with the same thoughtfulness and care you give to your patients. Let that guide you.

Let’s NOT Roll the Dice

I can’t tell you how many horror stories are out there, where investors are separated from their money. So invest in yourself, your career, your work. Anything you put in the market is savings, not speculation. Be careful if you find yourself saying things like:

- “Let’s roll the dice on this.”

- “I’m going to throw some money at…”

- “Let’s see how this works out.”

A Low Threshold for Pain

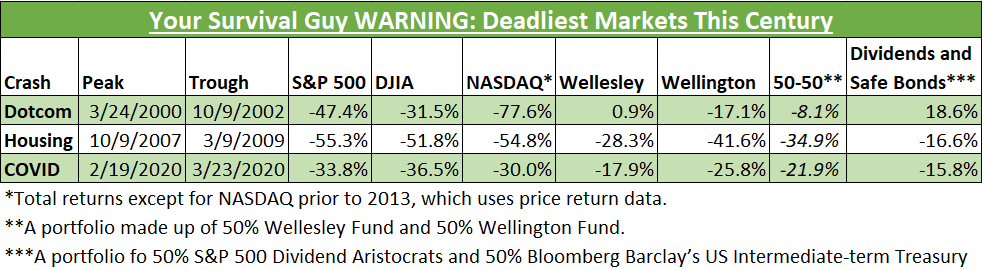

This leads me to risk tolerance. Too many investors believe their risk tolerance is high. That is until the stock market crashes, and then they realize it’s much lower than they thought. Then, in order to “feel better,” they sell at or near the bottom, often a devastating, near ruinous move.

In the aftermath of the crashes, the investor is stuck, not knowing when to get back in the market or is left too traumatized to invest. And it happens with much more regularity than most investors care to admit. A rising stock market tends to make investors forget about past losses—they have a short-term memory.

Stocks Down: -68%, -55%, and -30%

Let me remind you, so far this century, going back to the tech bust of 2000, the financial bust in 2007-2009, and Covid last year, NASDAQ was down peak to trough: -68%, -55%, and -30% respectively. That wiped out a lot of investors—someone’s selling out at those prices. Then you have the arithmetic of losses where if you lose 50%, you need a 100% gain just to get back to square one. And 100% gains are rare, especially when stocks can stay flat for a long time.

Dry Spells in Stocks Are the Norm

- At year-end 1965 through 1981, the price level of the Dow Jones Industrial Average was the same.

- It took the S&P 500 more than 13-years to get back to its 2000 high.

- And it took NASDAQ 16-years.

How to Survive a Dry Spell: Dividends

How do you survive such a dry spell? I prefer you invest in stocks that pay you to invest in the market in the form of dividends. Dividends help you survive and thrive during extended dry spells in the stock market. Blue-chip companies with a history of paying dividends for a long time and with a strong record of increases are my favorites. And as a shareholder, you get a seat at the boardroom table, so to speak, reminding them: “don’t forget the dividend.”

Buyer Beware: Know What You Own (Apple, Microsoft, Amazon, FB, Google)

If you don’t want to worry about picking stocks, there may be good value in the consumer staple-oriented funds or dividend payers offered by your 403(b). Understand what you own. For example, index funds that mirror the S&P 500 copy the index. The S&P 500 is a market-cap weighted index where the size of a company determines its impact on the performance of the index. The five biggest companies in the S&P 500 comprise 25% of the index today. That’s a quarter of the index controlled by only five companies.

Your 50s and Beyond

When you get into your 50s, start thinking about balancing out your portfolio. You can reduce the big ups and downs in your portfolio with a diversified mix of stocks and bonds. This counterbalancing is crucial as you get closer to retirement and don’t have as much TIME to wait for the market to come back. Because the market can stay down for a long, long time. Getting help from someone you trust might be a good idea.

PRESSURE

Warning: As your savings builds and you get closer to retirement, you have more to lose and less time to make it back. That means you start to feel the pressure. You try to avoid mistakes. But this can be paralyzing, and inertia can come at you hard, making it difficult to act.

One way to beat back inertia is to be consistent with your savings. Have a plan. Put a little away each month, set it and forget it. And then, you almost smile when the market goes down so you can buy at lower prices.

The Peace of Mind You Deserve

You’re so lucky. You have your career in front of you. You have time to let compound interest do its work while you do yours. You have the power to determine your success. I believe in you. I want you to have the retirement and peace of mind you deserve—because it will be here before you know it. Before you know it, 40 years will be behind you.

Make it a good 40-Years.

Warm regards,

E.J.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.