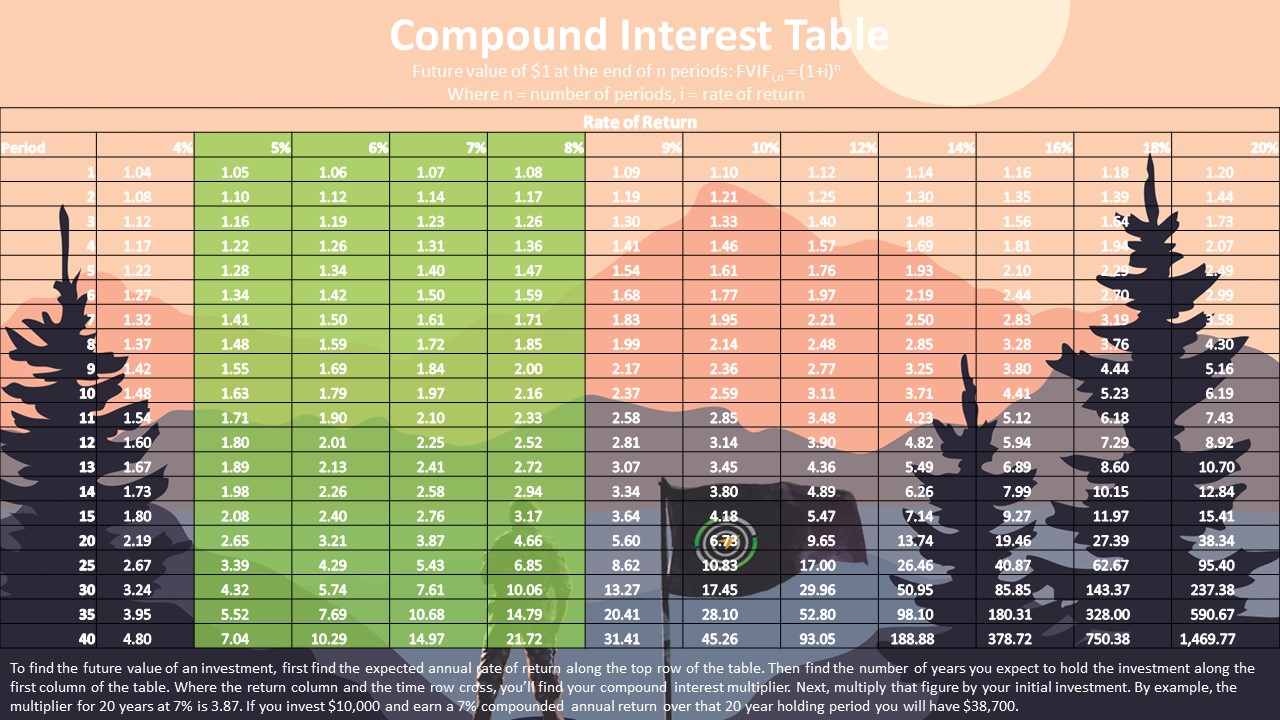

When it comes to money, my money, Your Survival Guy’s habit is to focus first and foremost on the return of assets and then, and only then, look at the return on them. No one I know likes losing money. And if you don’t have money to compound—in other words, you lost money—the magic of compounding can’t do its work.

I’ve been compounding money for most of my life, starting young with a paper route and scooping ice cream. Both taught me to appreciate a dollar earned and to be careful with my savings. Using the rule of 72, I want you to divide it by your rate of return and see more or less how many years it takes to double.

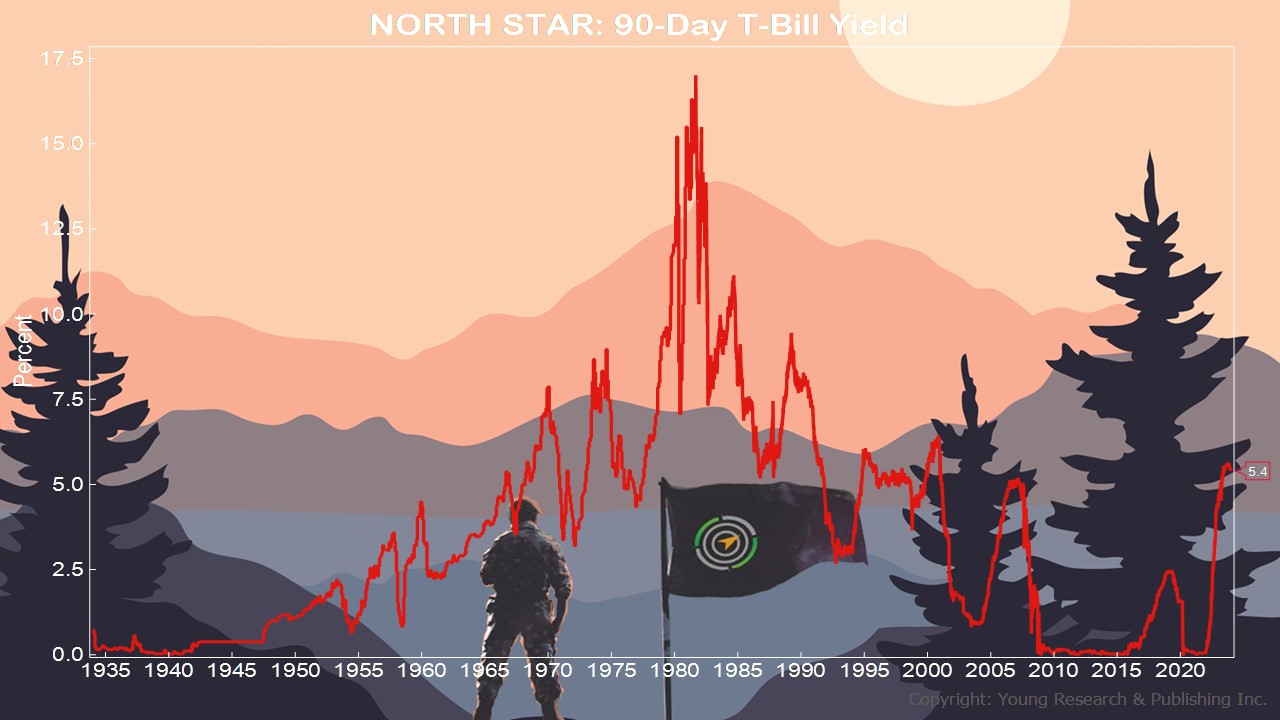

When you do this, you see the value of time. You don’t need huge numbers to put the miracle of compounding in your corner. Look at where interest rates are today using my North Star, and compare it to how far we’ve come. This is a great time to be a fixed-income investor.

When you get to a point in life where you don’t need the stock market to “do something” for you, then you have the peace of mind and temperament to get through tough ones. I don’t buy or sell based on what I think might happen. That’s guesswork. I look at what’s out there and act and invest accordingly. I review my investments periodically to make sure I’m comfortable with my plan and make minor adjustments here and there. That’s it. Easy to say. Hard to do.

Action Line: Let the North Star be your guide. Understand the simple yet hard habit of money. Be a compounding machine. If you need help, I’m here.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.