Once again, the Fed proves it’s a political beast, signaling yesterday that it’s open to rate cuts next year (as many as three) just in time for the election. Wow. You can’t make this stuff up. Inflation is beat? Hardly, as many of you who’ve gone out to dinner this holiday season know all too well.

Just when the savers of the world could invest (remember that word?) in bonds that actually pay something, the Fed pulls the rug out from under them. The pressure from Washington and Wall Street to “do something” proved once again to be too much to handle.

Americans can feel that something is wrong. Gold prices have been hitting around all-time highs as investors are nervous about the value of the dollar and the country’s future.

The perception of risk in the market is growing. And while some Americans will be happy to see interest rates decline, others see a signal from the Fed that it’s worried about the economy. Lowering rates is a sign that things are not well. It’s hard to pay a mortgage payment with no job, even at a lower rates. You can see that my RAGE Gauge monitor is pegged at full-tilt risk. America isn’t out of the woods yet.

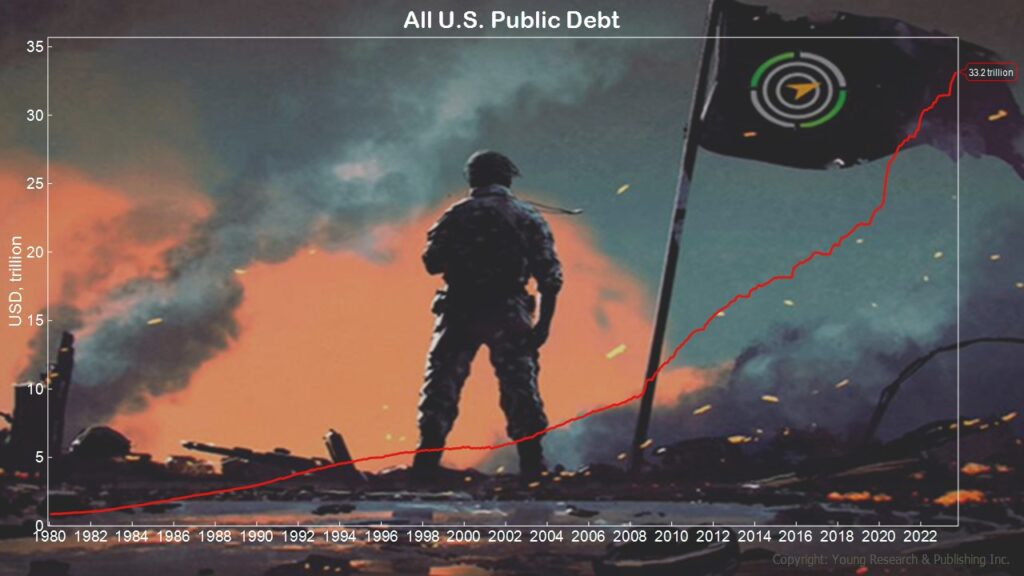

Look at the debt chart below, and you quickly realize something’s going to change. What hasn’t changed is the government’s default position of kicking the can down the road. Stay tuned.

Action Line: Need help navigating this bond market? I’m here when you’re ready to talk.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.