Today, the Bureau of Economic Analysis released its advance estimate of second-quarter GDP and confirmed that the U.S. has had two consecutive quarters of contraction. Despite mounting evidence that the U.S. economy is entering a phase of economic weakness, Federal Reserve Chairman Jerome Powell says that the full effects of the Fed’s recent rapid rate hikes have not been felt. The Wall Street Journal’s Nick Timiraos reports:

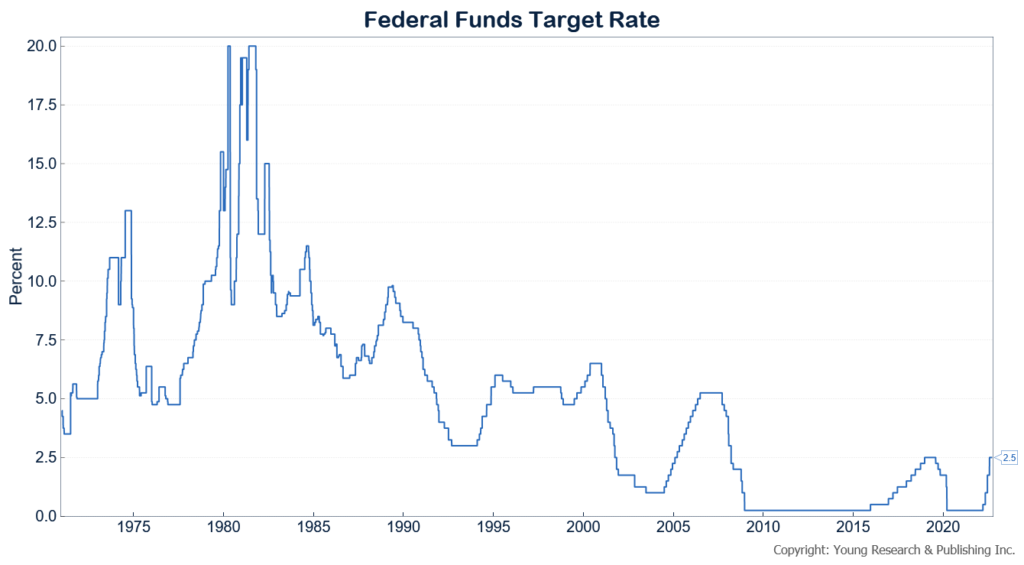

The Federal Reserve continued a sprint to reverse its easy-money policies by approving another unusually large interest rate increase and signaling more rises were likely coming to combat inflation that is running at a 40-year high.

Officials agreed unanimously Wednesday to lift their benchmark federal-funds rate to a range between 2.25% and 2.5%. But markets rallied after the meeting because Fed Chairman Jerome Powell offered fewer specifics about the magnitude of upcoming rate rises and hinted at an eventual slowdown.

Stocks rallied after Mr. Powell’s news conference. The S&P 500 gained 2.6% to close at 4023.61. Yields on the benchmark 10-year Treasury note fell to 2.79%.

Given Mr. Powell’s insistence that the Fed has to cause slower growth and accept rising recession risks to bring down inflation, “it is a bit surprising that all assets reacted in such an exuberant manner,” said Michael de Pass, global head of linear rates trading at Citadel Securities.

Mr. Powell said Wednesday it was too soon to say whether the Fed would dial down the size of its rate increases to a half-percentage point or a quarter-percentage point at its next meeting in September. But he said that at some stage, it would be appropriate to slow the pace of rate increases to assess their cumulative impact on the economy.

“These rate hikes have been large, and they’ve come quickly,” Mr. Powell said, referring to the Fed’s four consecutive rate increases since March. “And it’s likely that their full effect has not been felt by the economy, so there’s probably some significant additional tightening in the pipeline.”

The Fed chairman said the slowdown in economic growth during the second quarter had been notable, citing signs of cooling consumer spending, hiring and housing activity. “Are we seeing the slowdown in economic activity that we think we need?” Mr. Powell said. “There is some evidence we are, at this time.”

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.