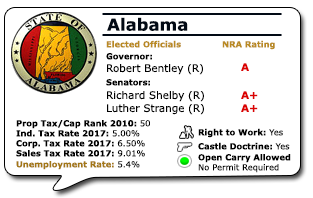

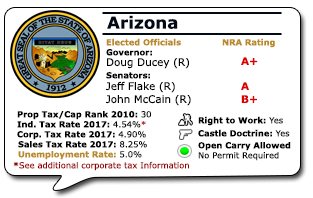

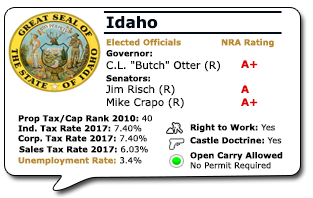

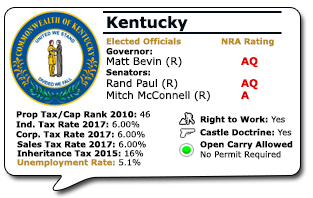

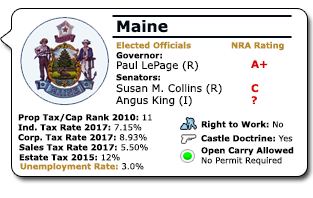

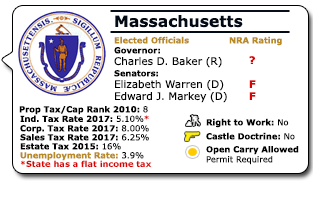

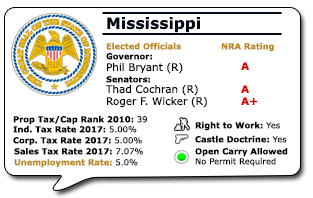

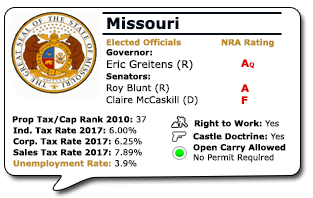

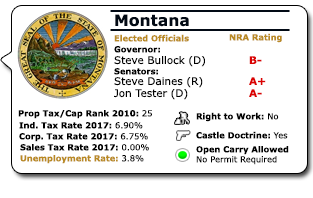

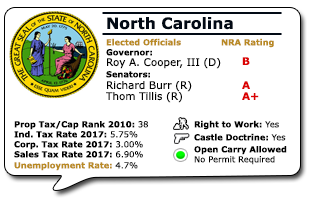

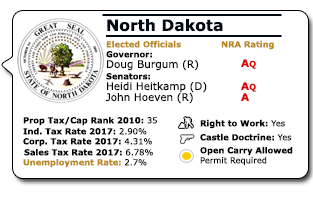

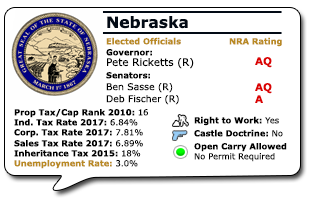

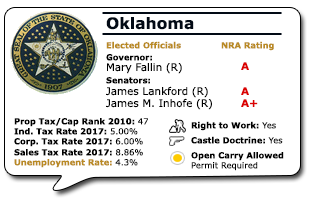

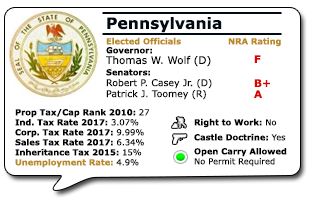

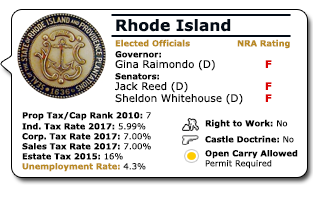

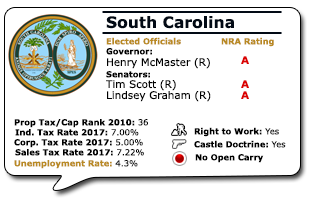

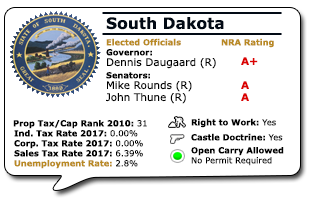

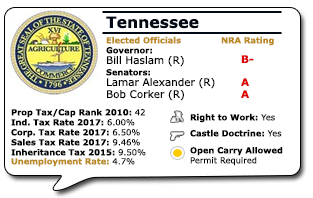

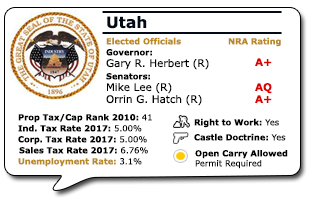

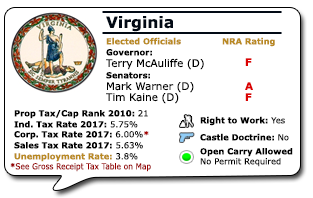

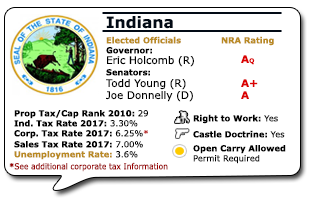

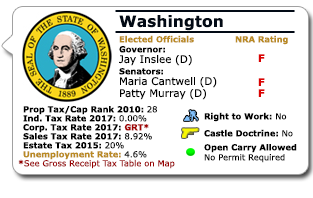

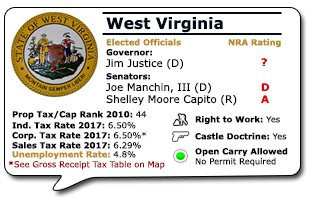

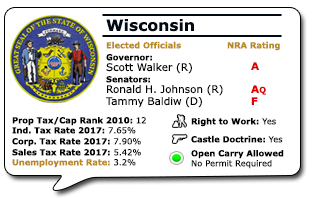

A+ A legislator with not only an excellent voting record on all critical NRA issues, but who has also made a vigorous effort to promote and defend the Second Amendment.

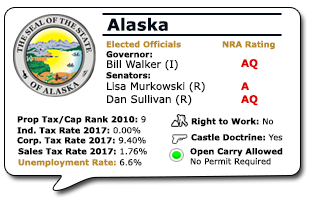

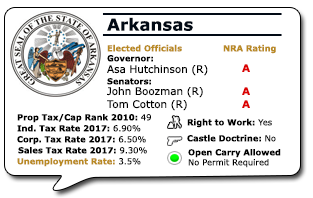

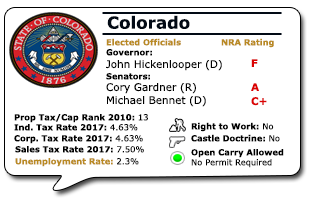

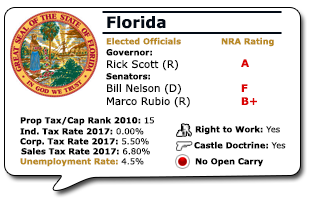

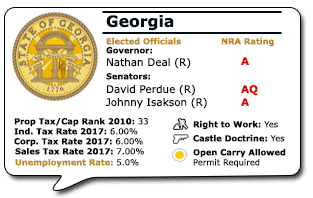

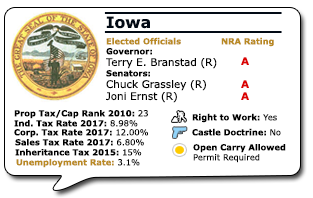

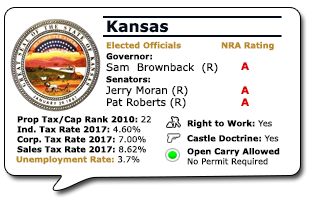

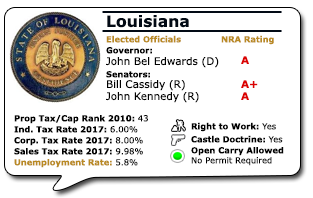

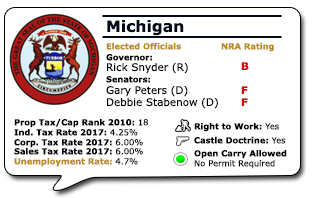

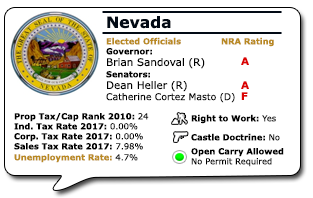

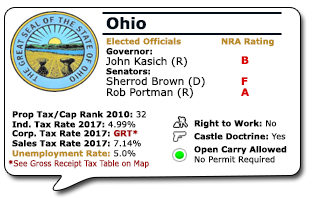

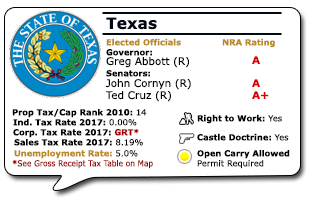

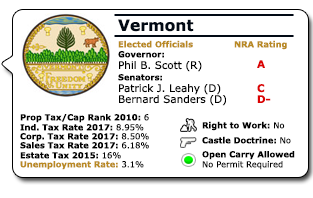

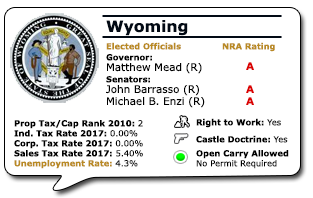

A Solidly pro-gun candidate. A candidate who has supported NRA positions on key votes in elective office or a candidate with a demonstrated record of support on Second Amendment issues.

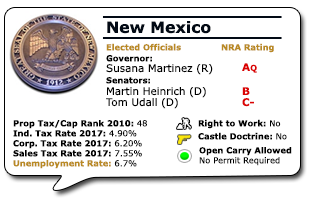

AQ A pro-gun candidate whose rating is based solely on the candidate’s responses to the NRA-PVF Candidate Questionnaire and who does not have a voting record on Second Amendment issues.

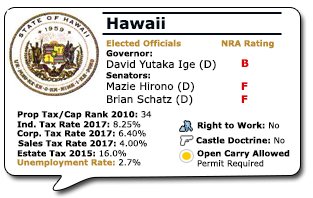

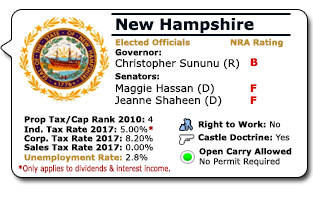

B A generally pro-gun candidate. However, a “B” candidate may have opposed some pro-gun reform or supported some restrictive legislation in the past.

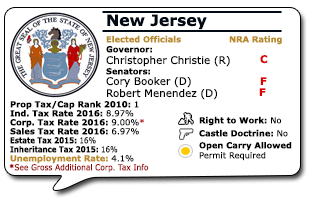

C Not necessarily a passing grade. A candidate with a mixed record or positions on gun related issues, who may oppose some pro-gun positions or support some restrictive legislation.

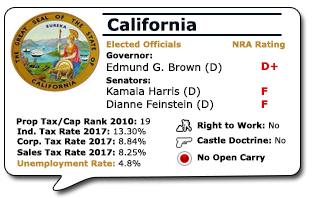

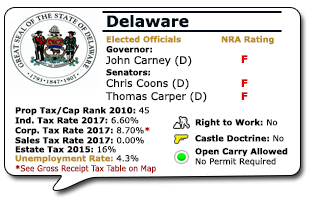

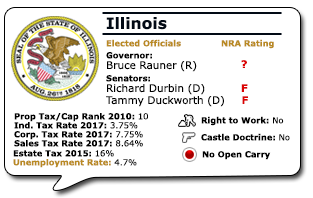

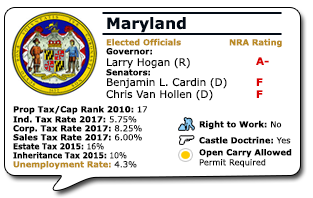

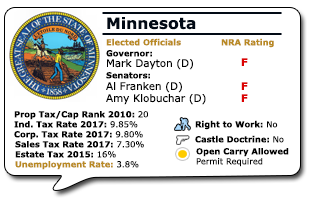

D An anti-gun candidate who usually supports restrictive gun control legislation and opposes pro-gun reforms. Regardless of public statements, can usually be counted on to vote wrong on key issues.

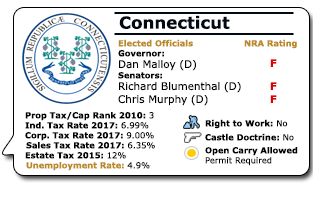

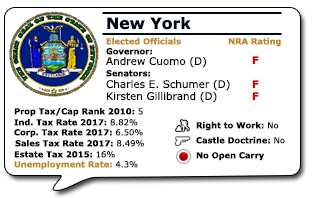

F True enemy of gun owners’ rights. A consistent anti-gun candidate who always opposes gun owners’ rights and/or actively leads anti-gun legislative efforts, or sponsors anti-gun legislation.

? Refused to answer the NRA-PVF candidate questionnaire, often an indication of indifference, if not outright hostility, to gun owners’ and sportsmen’s rights.

A Solidly pro-gun candidate. A candidate who has supported NRA positions on key votes in elective office or a candidate with a demonstrated record of support on Second Amendment issues.

AQ A pro-gun candidate whose rating is based solely on the candidate’s responses to the NRA-PVF Candidate Questionnaire and who does not have a voting record on Second Amendment issues.

B A generally pro-gun candidate. However, a “B” candidate may have opposed some pro-gun reform or supported some restrictive legislation in the past.

C Not necessarily a passing grade. A candidate with a mixed record or positions on gun related issues, who may oppose some pro-gun positions or support some restrictive legislation.

D An anti-gun candidate who usually supports restrictive gun control legislation and opposes pro-gun reforms. Regardless of public statements, can usually be counted on to vote wrong on key issues.

F True enemy of gun owners’ rights. A consistent anti-gun candidate who always opposes gun owners’ rights and/or actively leads anti-gun legislative efforts, or sponsors anti-gun legislation.

? Refused to answer the NRA-PVF candidate questionnaire, often an indication of indifference, if not outright hostility, to gun owners’ and sportsmen’s rights.

Follow Us:

From the National Right to Work Committee:

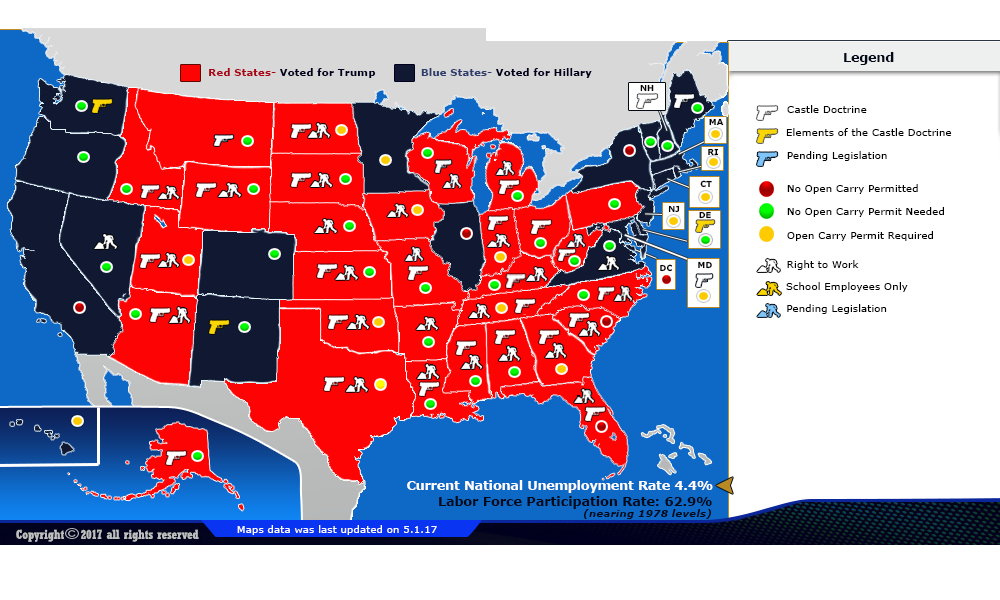

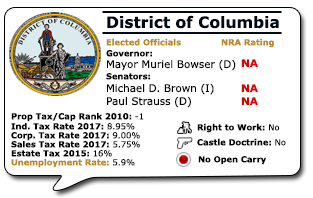

A Right to Work law guarantees that no person can be compelled, as a condition of employment, to join or pay dues or "fees" to a labor union. Such a law also reaffirms and strengthens the existing federal labor-law provisions that bar hiring discrimination against union members. Section 14(b) of the Taft-Hartley Act affirms the right of states to enact Right to Work laws.

A Right to Work law guarantees that no person can be compelled, as a condition of employment, to join or pay dues or "fees" to a labor union. Such a law also reaffirms and strengthens the existing federal labor-law provisions that bar hiring discrimination against union members. Section 14(b) of the Taft-Hartley Act affirms the right of states to enact Right to Work laws.

Corporate Tax Info: Click here for additional Corporate tax information (Below)

Note on Property Tax Ranks: A rank of 1 equals the highest tax per capita, 50 equals the lowest.

Note on Property Tax Ranks: A rank of 1 equals the highest tax per capita, 50 equals the lowest.

From the NRA:

"Castle Doctrine" law does the following:

One: It establishes, in law, the presumption that a criminal who forcibly enters or intrudes into your home or occupied vehicle is there to cause death or great bodily harm, so the occupant may use force, including deadly force, against that person.

Two: It removes the "duty to retreat" if you are attacked in any place you have a right to be. You no longer have to turn your back on a criminal and try to run when attacked. Instead, you may stand your ground and fight back, meeting force with force, including deadly force, if you reasonably believe it is necessary to prevent death or great bodily harm to yourself or others.

Three: It provides that persons using force authorized by law shall not be prosecuted for using such force. It also prohibits criminals and their families from suing victims for injuring or killing the criminals who have attacked them. In short, it gives rights back to law-abiding people and forces judges and prosecutors to focus on protecting victims.

"Castle Doctrine" law does the following:

One: It establishes, in law, the presumption that a criminal who forcibly enters or intrudes into your home or occupied vehicle is there to cause death or great bodily harm, so the occupant may use force, including deadly force, against that person.

Two: It removes the "duty to retreat" if you are attacked in any place you have a right to be. You no longer have to turn your back on a criminal and try to run when attacked. Instead, you may stand your ground and fight back, meeting force with force, including deadly force, if you reasonably believe it is necessary to prevent death or great bodily harm to yourself or others.

Three: It provides that persons using force authorized by law shall not be prosecuted for using such force. It also prohibits criminals and their families from suing victims for injuring or killing the criminals who have attacked them. In short, it gives rights back to law-abiding people and forces judges and prosecutors to focus on protecting victims.

The U.S. Constitution:

Second Amendment

A well regulated militia being necessary to the security of a free State, the right of the people to keep and bear arms shall not be infringed.

Ninth Amendment

The enumeration in the Constitution, of certain rights, shall not be construed to deny or disparage others retained by the people.

Tenth Amendment

The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.

Click here for the Thirteenth, Fourteenth, & Fifthteenth Amendment.

Second Amendment

A well regulated militia being necessary to the security of a free State, the right of the people to keep and bear arms shall not be infringed.

Ninth Amendment

The enumeration in the Constitution, of certain rights, shall not be construed to deny or disparage others retained by the people.

Tenth Amendment

The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.

Click here for the Thirteenth, Fourteenth, & Fifthteenth Amendment.

Additional Corporate Tax Info:

State Gross Receipts Taxes: as of 1/01/2013:

- Ohio, Texas, and Washington do not have a corporate income tax but do have a gross receipts tax with rates not strictly comparable to corporate income tax rates. See Table 21 for more information. Delaware and Virginia have a gross receipts tax in addition to the corporate income tax.

- Illinois’s rate includes two separate corporate income taxes, one at a 7% rate and one at a 2.5% rate.

Note: In addition to regular income taxes, many states impose other taxes on corporations such as gross receipts taxes and franchise taxes. Some states also impose an alternative minimum tax. Some states impose special rates on financial institutions.

State Gross Receipts Taxes: as of 1/01/2013:

- Ohio, Texas, and Washington do not have a corporate income tax but do have a gross receipts tax with rates not strictly comparable to corporate income tax rates. See Table 21 for more information. Delaware and Virginia have a gross receipts tax in addition to the corporate income tax.

- Illinois’s rate includes two separate corporate income taxes, one at a 7% rate and one at a 2.5% rate.

Note: In addition to regular income taxes, many states impose other taxes on corporations such as gross receipts taxes and franchise taxes. Some states also impose an alternative minimum tax. Some states impose special rates on financial institutions.

- Conneticut rate includes a 20% surtax, which effectively increases the rate from 7.5% to 9%. Surtax is required by businesses with at least $100 million annual gross income.

- The tax rate in Indiana will decrease to 7.5% on July 1, 2013.

- Arizona’s rate is scheduled to decrease to 6.5% in 2014.

- New Jersey - Corporations with entire net income greater than $100,000 pay 9% on all taxable income, companies with entire net income greater than $50,000 and less than or equal to $100,000 pay 7.5% on all taxable income, and companies with entire net income less than or equal to $50,000 pay 6.5% on all taxable income.

- West Virginia’s rate is scheduled to decrease in 2014 subject to a reserve requirement.

- The tax rate in Indiana will decrease to 7.5% on July 1, 2013.

- Arizona’s rate is scheduled to decrease to 6.5% in 2014.

- New Jersey - Corporations with entire net income greater than $100,000 pay 9% on all taxable income, companies with entire net income greater than $50,000 and less than or equal to $100,000 pay 7.5% on all taxable income, and companies with entire net income less than or equal to $50,000 pay 6.5% on all taxable income.

- West Virginia’s rate is scheduled to decrease in 2014 subject to a reserve requirement.